A Focus On Hyper-Personalization And How It Helps Foster Trust And Loyalty In Financial Services

In today’s increasingly competitive environment, a personalized but relevant experience can make all the difference. Despite ongoing concerns about data privacy and security, consumers have come to appreciate experiences that are customized to their personal needs and interests.

This points to a very interesting paradox-although data security is more important than ever before, people understand that the providers they do business with have access to a great deal of their personal information… and they expect their providers to use this information to create relevant customized experiences.

In this blog post we explore hyper-personalization, including the recent findings of Keypoint Intelligence’s research, and discuss the value of hyper-personalization in financial services.

Understanding Hyper-Personalization

Hyper-personalization incorporates real-time customer data and artificial intelligence (AI) to ascertain the most relevant content on an individual level. It’s the next step in a personalized marketing approach, and goes far beyond basic information like name, address, or email, by embracing relevant and intent-driven communications.

According to the US Census Bureau, over half of Americans are no older than age 40-meaning that the oldest within this group are Millennials. As a result, today’s marketers need to rethink how content is presented so they can engage younger consumers.

Younger consumers grew up with digital, but COVID-19 forced us all into the digital world almost overnight. Although younger consumers understand that new technologies can enhance their lives, they are also wary of “digital dependence.”

Young people know about artificial intelligence (they see it every day when Google tries to finish their search entries or Amazon recommends products for them to purchase), but they still want to be treated like individuals.

This is particularly the case during pandemic times, when people are still somewhat isolated from one another and need guidance, especially when it comes to their finances, so they rely on financial institutions to help with making informed decisions.

The value of hyper-personalization in financial services is therefore undeniable.

A hyper-personalized experience demonstrates that a business values customers on an individual level, fostering trust and loyalty.

Personalization Makes a Difference!

Recent research from Keypoint Intelligence confirms that consumers recognize and respond to personalization. The statistics tell the story.

According to our most recent marketing communications research:

- About 45% of consumers spent much more time reviewing digital marketing communications that were personalized and relevant to them than generic communications. This share was even higher for direct mail (52%).

- Cited by 43% of consumers, personalization was the top factor that made consumers more likely to read or review a digital marketing communication.

- Only about 37% of consumers were frequently or very frequently receiving highly personalized marketing communications, so is there is certainly room for improvement.

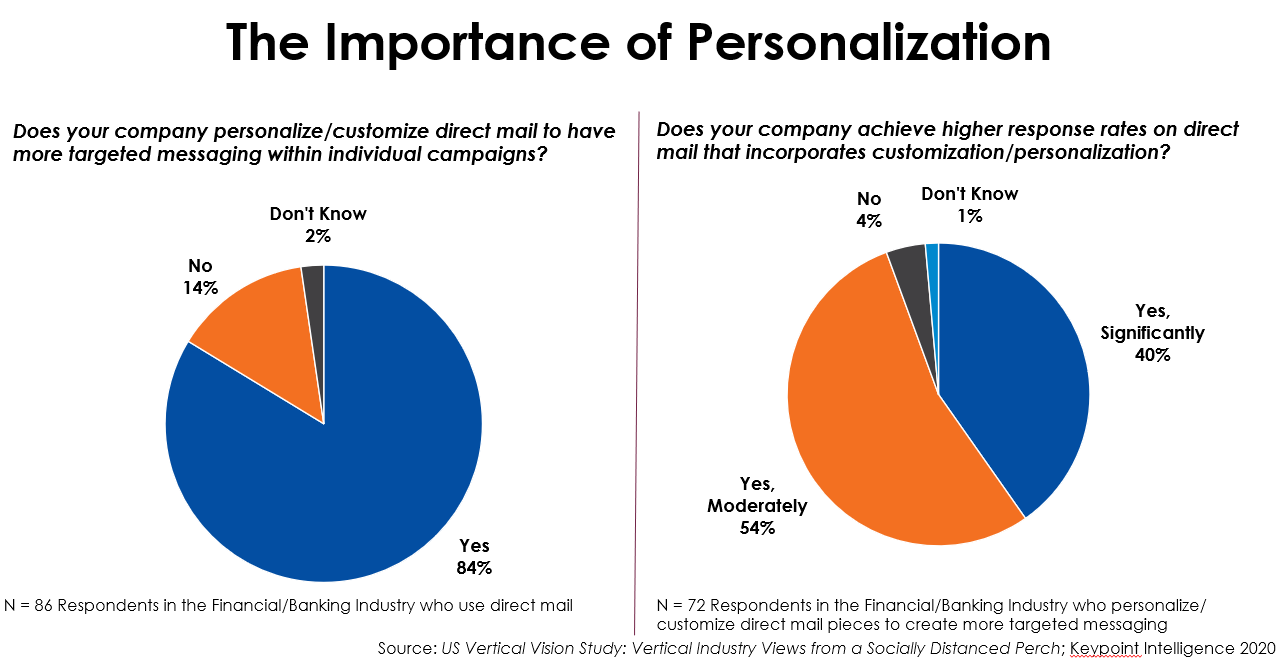

Personalization is clearly important to consumers, and businesses are getting the message. According to Keypoint Intelligence’s Vertical Visions research, 84% of financial/banking firms that used direct mail customized or personalized these pieces to have more targeted messaging. Of these firms, the vast majority report significantly or moderately higher response rates on personalized/customized direct mail.

Delivering Relevant Content Across All Channels

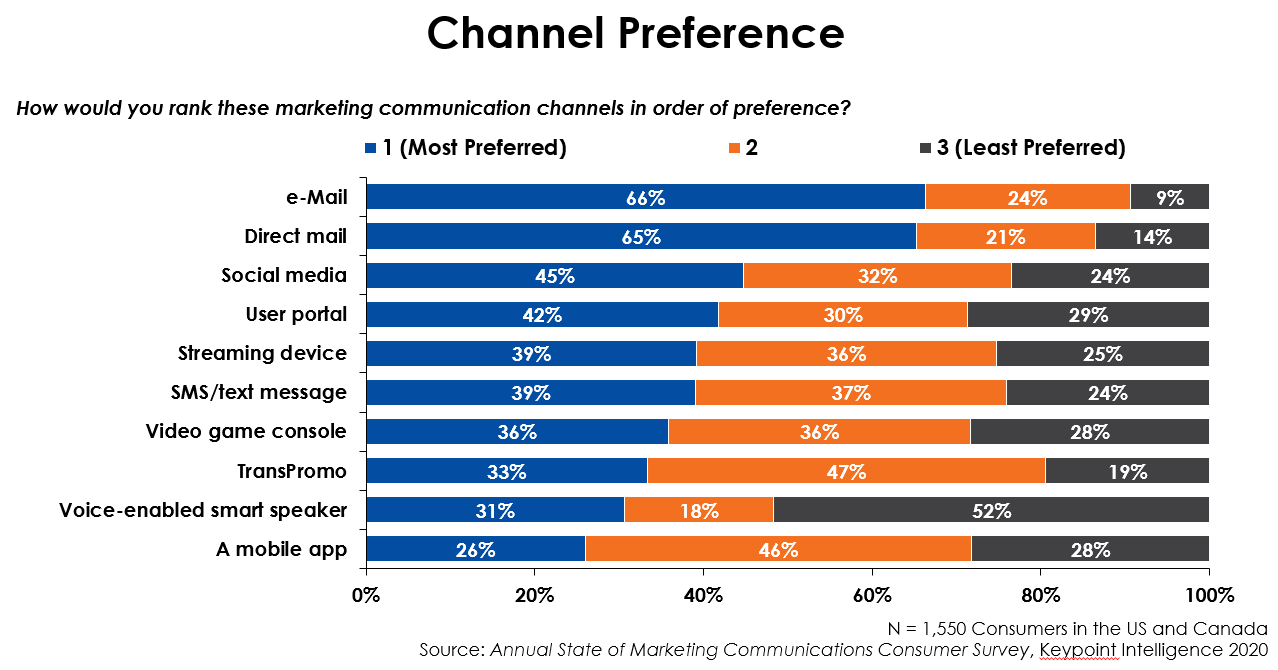

Communicating clearly with customers has never been more important for financial institutions. While consumers continue to increasingly use digital channels to manage their finances, their preferred channel of communication is still an almost even mix of digital and physical (see Figure below).

With that said, it’s important not to overlook the power of hyper-personalized, data-driven direct mail. As discussed earlier in this blog series, data-driven direct mail is experiencing a resurgence, particularly when it’s part of an omnichannel experience.

Driving a Better Customer Experience

Well-publicized email scams and security breaches have caused consumers to become more protective of their personal data, and the onset of COVID-19 has only served to accelerate these concerns. As a result, there is a growing reliance on first-party data-the data that financial services firms receive directly from their customers and prospects.

Today’s marketers must strike a balance between respecting consumers’ privacy while still leveraging key consumer data to deliver highly relevant communications. The key is balancing your ability to demonstrate an understanding of your customers, while delivering on an experience that is not only based on trust but is highly relevant and personalized to meet their needs.

Consumers entrust their financial services providers with a great deal of sensitive personal information. Savvy financial services firms find a way to develop hyper-personalized communications that establish a true connection and build a relationship that fosters trust rather than eroding it.

Ultimately, the use of hyper-personalization in financial services can help drive a better customer experience.

Hyper-personalization empowers financial services providers to clearly respond to their customers’ needs. Consumers are used to having lots of choices, but too many options can be overwhelming when it comes to their financial health.

Hyper-personalization solves this problem by presenting consumers with the options that are best suited to their specific needs only.

Hyper-personalization can enable brand differentiation and improved revenues.

To remain competitive, financial services firms must truly understand their customers so they can foster a lasting connection with them.

The Bottom Line: Hyper-Personalization in Financial Services is Key

With this series of blogs, my colleague Eve Padula and I have shared some of the key trends uncovered by Keypoint Intelligence’s recent research. As previously stated, no single trend stands alone-customer communication channels are all interdependent on each other to drive loyalty and satisfaction.

Financial services firms are uniquely well-positioned to offer hyper-personalization because they already have access to a large amount of customer data that can create a better experience.

The relationship between a financial services provider and its customers is all about trust-consumers entrust their providers with a great deal of their personal data, and they depend on their providers to not only keep this information safe, but also to use it to create the best experience possible.

Once this trust has been established, customers will feel protected, loyal, and connected to their providers. They will then be less likely to switch from one financial services provider to another based solely on price.