About us

Customers today expect engagement that is personalized, interactive, and delivered in their channel of choice.

Who We Are

Doxim is a customer communications management and engagement-technology leader serving highly regulated organizations globally across the United States, Canada, the United Kingdom, and Africa.

Doxim was founded in 2000 as a digital-first company helping regulated clients on their digital transformation journey. Since that time, we have grown organically and by carefully acquiring companies to expand core service offerings and apply them to wider industry markets.

Today, Doxim is proud to partner with over 2,000 clients in highly regulated industries. Our software and managed services strengthen engagement across the customer lifecycle addressing key digitization, operational efficiency, and customer experience challenges.

Doxim Delivers Personalized, Omnichannel Communications at Scale

2.2B+

impressions/images

600M+

Mail pieces

1.5B+

Documents archived

and ePresented

400M+

Alerts and notifications by email, SMS

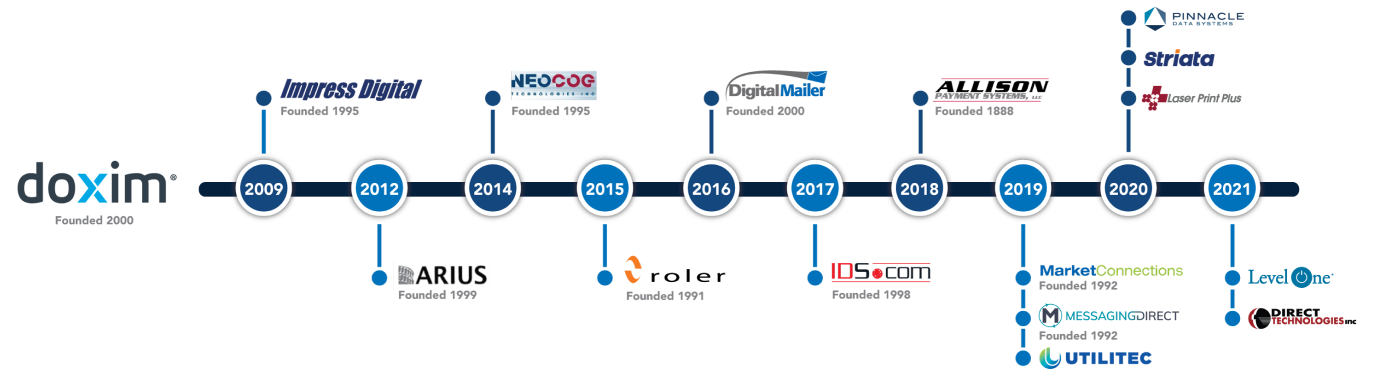

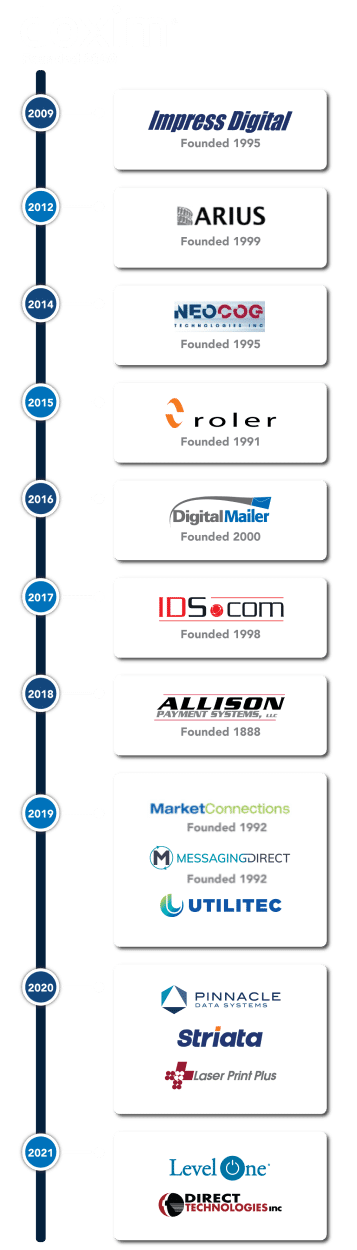

Our History of Growth

Our History of Growth

Over the years, Doxim has made a number of strategic acquisitions to deliver a complete range of customer communication solutions in the financial services, insurance, healthcare, government, and utility sectors. Here’s a look at the notable acquisitions Doxim has made over the past two decades.

The Doxim Difference

Doxim is different. We help highly regulated organizations digitize all the right moments along the customer journey to connect with and serve today’s consumers, creating better experiences at a fraction of current operating costs.