Customers’ communication preferences are constantly shifting, so organizations must ensure that they are communicating with customers accordingly

We have been weathering the COVID-19 pandemic storm for a year now, so most of us have grown tired of the phrase “new normal.” It started out as a catchy buzz term many months ago, but at Keypoint Intelligence, we have often contemplated whether this phrase really applies to the customer communications market. You see, customer communication channels have been in a state of flux for several years now, long before terms like “global health crisis” and “social distancing” became part of our everyday lexicon.

What could be considered a game-changing “new normal” for the financial services industry started over five years ago when the world began to take on paperless adoption. The truth is that communication channels are in a constant state of flux, ebbing and flowing with their intimate connection to customer communication preferences. Rather than shifting on a dime with the so-called “new normal,” consumer preferences hinge on innovations and the timing of how (or even if) consumers gravitate toward them.

Concerns About Data Security

While we can hardly dismiss the “new normal” that 2020 ushered in, it’s important to take a step back and truly understand the forces that drive customer communication preferences. We could overwhelm ourselves with a myriad of data points, but it is much easier to simply look at the trends in the financial services industry.

Past and existing trends contribute to understanding how certain customer communication channels come in and out of favor, but they can also be predictive of emerging trends-and more importantly, emerging innovations. It is clear that consumer communication channel preferences are changing all the time- the pandemic has only served to accelerate these changes.

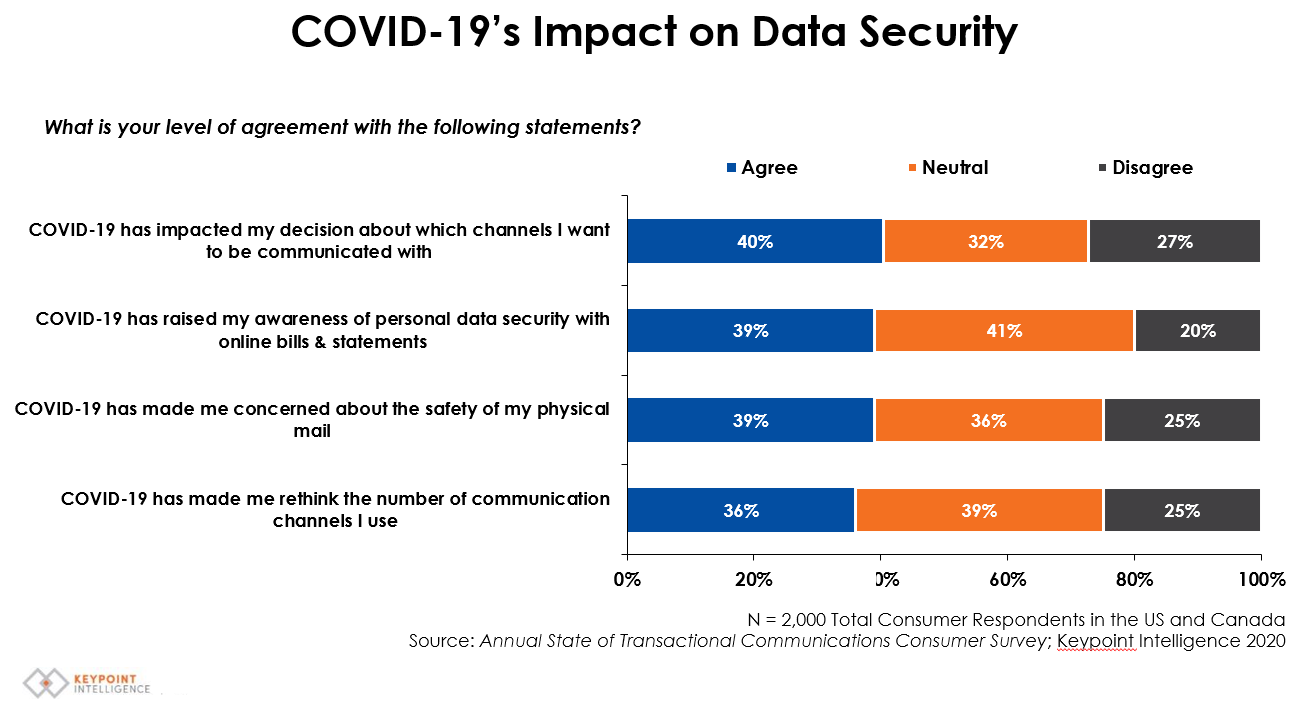

According to Keypoint Intelligence’s most recent transactional communications research, COVID-19 has caused many consumer respondents to rethink their communication preferences.

- About 40% of survey participants were thinking more about the channels they chose to be communicated with

- 39% Reported heightened awareness about the security of online bills and statements. Keypoint Intelligence’s ongoing research confirms that these concerns have increased over the past three years, and consumers have become particularly wary about the security of their financial information.

Although these consumer concerns have existed for a while and are therefore not representative of a “new normal,” computer security software vendors are certainly heightening consumer awareness via TV and social media and thus contributing to the uncertainty surrounding digital channels. .

What Do Consumers REALLY Want?

At the end of the day, the primary objectives of any enterprise or brand are to strengthen customer retention rates and increase share of wallet-and both of which hinge on customer loyalty.

Customer loyalty is often rewarded with discounts or special offers and it is a primary focus for credit card providers, credit unions, and more recently credit-related mobile apps. Although discounts and special offers are certainly a benefit, they may not be top-of-mind for consumers.

According to Keypoint Intelligence’s transactional communications research, consumers had different ideas on how their providers could make them more engaged and loyal customers.

Rather than discounts or other incentives, consumers most cited the following:

- Ensuring that personal data was kept secure when using digital communications.

- The ability to select one’s own customer communication preferences.

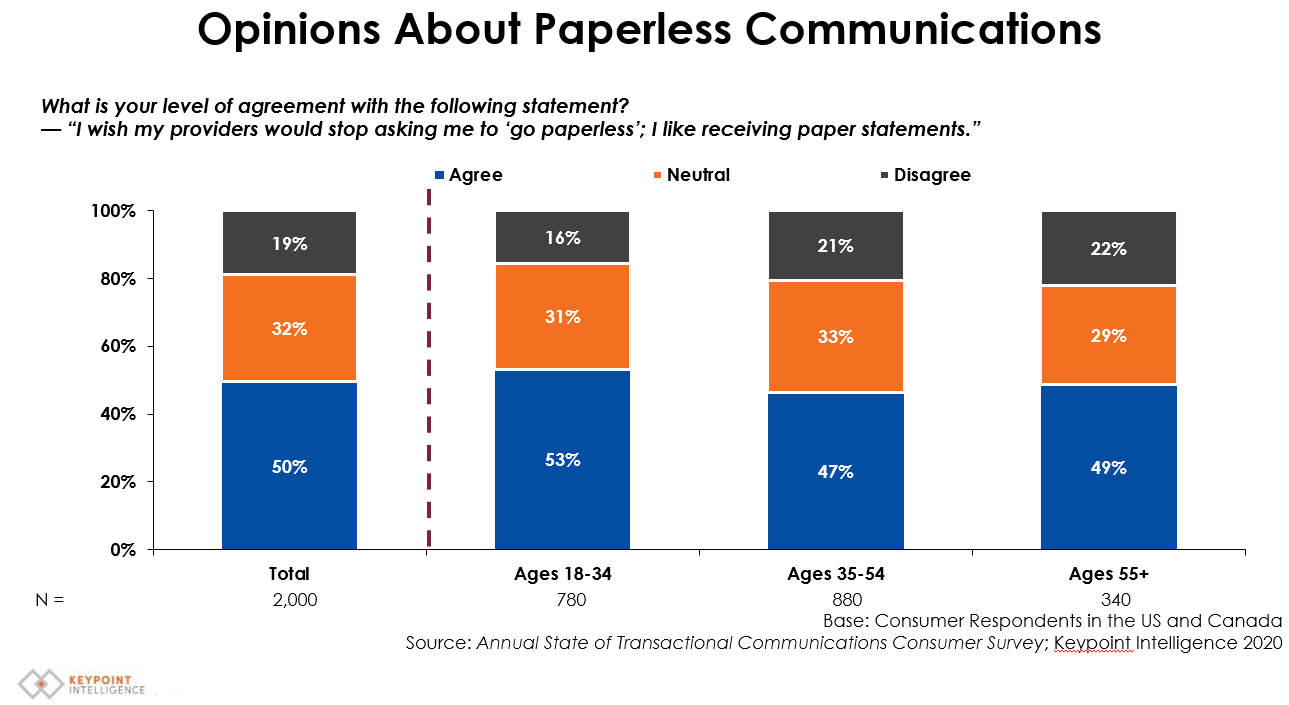

In a similar vein, it is important for service providers not to make assumptions about their customers’ communication preferences based on age or other demographics. Despite its “old school” nature, roughly half of total respondents to Keypoint Intelligence’s transactional communications research reported that they liked receiving paper statements. Even more compelling, was the evidence that younger consumers were more likely to cite an aversion for going paperless than their older counterparts!

The Bottom Line

In the coming months, my colleague Eve Padula and I will share some of the key trends uncovered by Keypoint Intelligence’s recent research. As was the case with this post, we will explore how no single trend stands alone-instead, all are woven together in an intricate relationship between consumers’ ever-evolving preferences and propensity to change communication channels.

In future blog posts, we will take a deeper dive into customers’ channel preferences and explore which types of communications are best suited to which channels. We will also cover more recent innovations that are driving customer communications in the financial services industry, like Artificial Intelligence (AI) and hyper-personalization. Finally, we’ll explore how trends that are influencing adjacent industry sectors can directly impact customers’ channel preferences in the transactional space.

As you review your existing customer communications strategy, we leave you with one final thought-just as businesses become more keenly aware of their financial burdens and monthly expenditures during an economic downturn, so do consumers. Credit card, cable, and cell phone bills that might have been overlooked during better times are now being scrutinized in detail.

Economic uncertainty plays a key role in the mindset and well-being of consumers, particularly as they increase their focus on their financial bills and statements. Today’s consumers do not want to be frustrated with where or how they receive their communications; the information that they require must be clear and concise to ensure satisfaction and loyalty.

It is clear that customers’ communication preferences are constantly shifting and enterprises, as well as brands must ensure that they are communicating with customers according to their individual preferences.

Innovations continue to impact all customer communication channels, and what worked for a consumer six months ago might not be good enough anymore. Enterprises need to respond to their consumers’ ever-changing needs in real time, which is no easy task as these preferences have been changing for years.

Rather than focusing on the new normal, prepare yourself for the interactions of tomorrow, which rely on up-to-the-minute data and personalization to drive loyalty and improve engagement.