The Impact Of Digital Transformation On CX In Banking

Doxim recently co-hosted a webinar with The Financial Brand. One of the discussion points was the state of digital transformation in banking, and how it impacts customer experience.

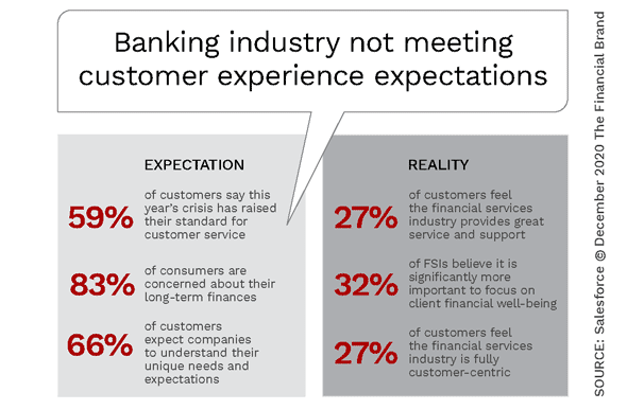

According to guest speaker Jim Marous, owner of the Digital Banking Report and Co-Publisher of The Financial Brand, there is a massive performance gap between what banking customers expect when it comes to customer experience (in general, across channels) and what banks are providing.

“66% of customers expect finance companies to understand their unique needs and expectations. But only 27% of customers feel the financial services industry provides great service and support.”

The bottom line is, prior to the pandemic, banks were not meeting customer experience expectations and this “gap of dissatisfaction” has widened notably since.

Consumers are now more demanding, expecting their financial institutions to not only manage their financial affairs but also contribute to an improvement in their quality of life. As much as 59% of customers agreed that the crisis raised their standard for customer services.

Here are some of the key takeaways from the webinar relating to digital transformation in banking, and the impact on CX:

Banks need to work towards customer insight maturity

Customer insight maturity relates to the degree of accuracy and comprehensiveness of the bank’s insight into each customer. This is important, as customer insight maturity directly affects engagement and customer satisfaction.

When a bank has a high level of customer insight maturity, it means the institution knows and understands their customer and rewards them from the beginning of the relationship onwards. From the moment the customer opens an account, they feel seen, understood and appreciated.

A low level of customer insight maturity means the bank is still hung up on product-based campaigns that treat customers as part of a segment. These campaigns focus on what the company provides, rather than what the individual customer wants and needs.

The way to achieve high customer insight maturity is through data, analytics and the personalization of experiences, all of which are achievable through digital transformation.

Customers will trade information for value, but not in the absence of trust

There are two primary factors involved in encouraging customers to share information with their bank.

- Consumers expect companies to personalize offers and experiences and are willing to share information with their bank if they believe they are getting value in return. But banks are no longer being compared to their peers alone. Consumers are comparing the value and experience they receive to the likes of Amazon, Netflix, Apple Pay and Uber, as well as every other engagement they have been involved in.

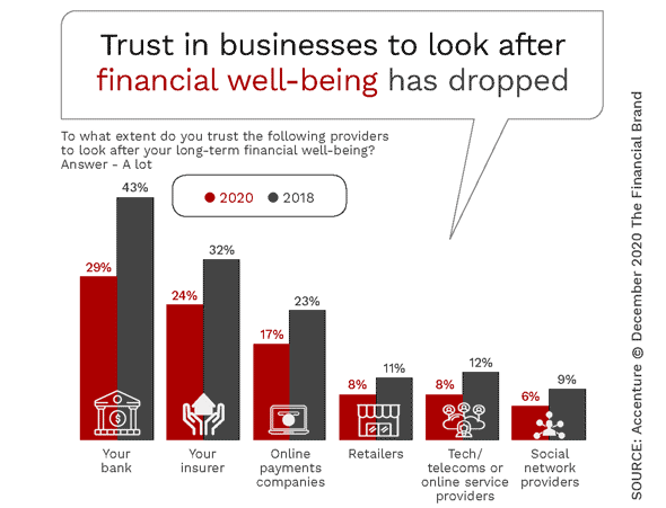

- The other factor is trust. Building a trust relationship is directly tied to the ability to personalize the experience through information, offers and advice that is highly relevant to the individual’s circumstances.

Consumer trust in the ability of banks to look after their financial well-being dropped from 43% in 2018 to 29% in 2020.

Omnichannel experience is harder to achieve but more important than ever

Another result of the pandemic is the escalation in adoption and usage of digital channels, such as mobile apps and online banking. Most would agree that this change in channel use will be permanent and continue to grow.

That’s not to say that physical branches will disappear, rather banks need to invest in all channels in order to offer engagement options and allow the customer to select those that they prefer.

To create a seamless, consistent experience across channels, banks need to have a view of the customer’s interaction across the organization. Without this, customers will still feel like they are dealing with different departments and get frustrated when having to repeat or re-explain information to different representatives.

One way to move towards a seamless omnichannel experience is to offer omnichannel communication based on the customer’s preference.

For more insights on digital transformation in banking, watch the on-demand webinar: How communication drives digital banking transformation and maximizes customer lifetime value. WATCH THE WEBINAR ON DEMAND