Transformative businesses across the economy (e.g. Uber, Netflix, and Amazon) are continually moving the goalposts for digital services and, as a result, reframing customer expectations. To keep up, utilities must do the same. Embracing digital services like other innovators allows utilities to increase customer satisfaction scores.

When assessing the state of utilities, an increasingly widening gap is evolving between the highest performing utilities and those trailing behind. The difference, according to Business Wire, is in how the top-performing utilities use digital services to engage customers:

“Electric utilities around the country have been ramping up their communications efforts, often addressing everything from mobile alerts about outages to updates on citizenship initiative. Many top-performing utilities are getting that formula right, by visibly maintaining their infrastructure and leveraging technology to ensure businesses receive timely information needed to deal with outages and support decision-making. However, several utilities are still missing the mark by not focusing on these areas that drive customer satisfaction.” – JD Power

When looking at how utilities should digitally transform customer service and communication, a common theme emerges: data is the foundation of the future utility.

Customers Crave Personalization

Regardless of industry, customers want to be treated personally as a unique person with their own specific needs. When reviewing CCM in utilities, it’s clear that the most effective programs are the ones that recognize this fact and adapt accordingly.

“In fact, 72% of contact center callers expect customer service representatives (CSR) to know they are a customer, along with their product and service history when they contact the provider.” – EnergySavvy

For utilities, this approach would ensure, for example, that customers in apartments aren’t receiving information on installing rooftop solar panels or customers who already use a utility weatherization program don’t get recommendations to participate in such.

These missteps suggest to utility customers that their needs aren’t being evaluated uniquely. When they don’t see that personalization, they may ignore future communications: relevant letters may go unopened, pertinent emails deleted, and so, the utility will lose the opportunity to reach them with programs that are relevant.

Conversely, when personalized customer engagement is prioritized, customers are more likely to be happy with the service.

92% of consumers surveyed would be more satisfied if their energy provider could personalize their overall customer experience; What’s more, 78% would use more digital channels if offered a personalized experience across them – Uplight

Efficiency in Customer Operations

The effective leveraging of customer data allows the utility to build customer connections. Once that data is an integrated part of the utility, operations can deliver effective, customized experiences through targeted services that help connect with those customers.

For example, applying customer data in the creation of the bill can reduce the costs associated with producing and delivering additional communications. Every time a utility must print and mail past due or shut off notices, it costs money. Even worse, the process of shutting off power and then later reinstating it for individual customers also uses precious resources.

If, however, customer data is applied earlier in the process to highlight the risk of shutoff, such as using red or bolded text in customer billing, escalation to the next steps may be avoided.

70% of low-income customers who are disconnected reconnect within 48 hours because they find a way to pay. If utilities reach these customers before disconnecting, the costly process can be avoided and the remaining 30% can be more handled in a more optimal, personalized, and cost-effective manner.

Additionally, if the utility taps into its data to determine how each individual customer typically interacts with it (e.g., paper notices vs. mobile apps vs. web portal vs. email), then it will know the optimal channel it can use to reach each customer. This knowledge can likewise prevent escalating the issue to costly shutoff.

Leveraging customer data in this way enables utilities to realize a great return on investment. Data-driven bill design and customer engagement ensures cash flow persists. Customers, meanwhile, avoid the unpleasant process of past-due notices and shutoffs.

Evaluating the State of Utility Data Collection and Utilization

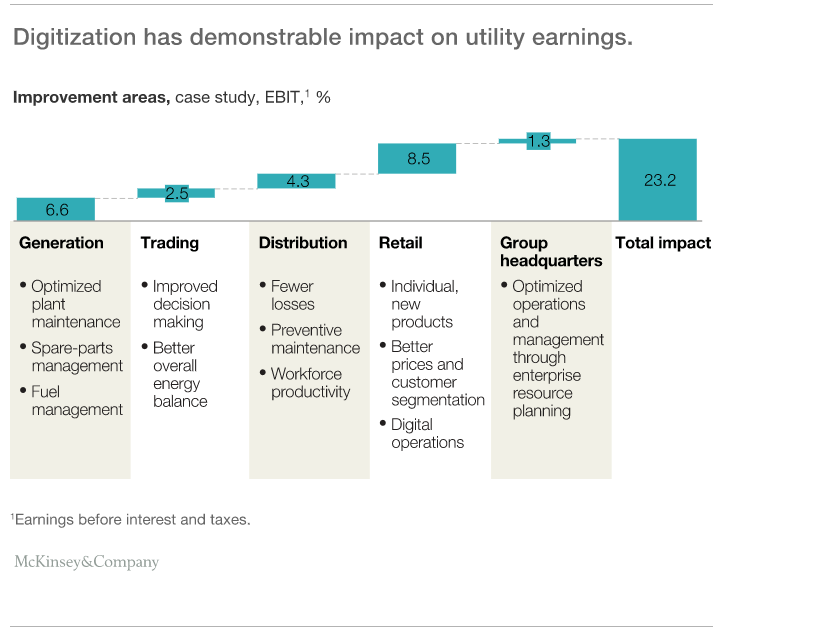

Utility leaders often think of utility data as being most useful for grid operations. But, in fact, the greatest bottom-line impact that data can have happens at the retail level-where the customer is engaged and offered appropriate products:

Proper customer personalization means communications are relevant to the individual, delivered in the right method and at the right time, and packaged to suit the individual household.

Across all industries, only 9% of customer experience professionals rate their companies as being very effective at personalization, with 29% evaluating them as not very effective. Utilities can be chief culprits, with obsolete and siloed data comprising 10-30% of an average energy retailer’s cost to serve.

Care must also be taken on the accuracy and proper handling of data. If data is inaccurate, it will lead to customers getting inopportune offers, which will lead to poor customer engagement. These issues can feed into a public reputation impact from dissatisfied customers sharing their experiences online.

Another key risk when handling data comes from ensuring data privacy. If utilities try to embrace utility data processes, but do so poorly or sloppily, they risk contravening critical regulations on data privacy. In today’s digital world, data security is paramount. The protection of personal information is not just the right thing to do, it’s a regulatory requirement.

Collecting, cleaning, and safely using data is challenging for any enterprise, so tapping into existing data analytics expertise is critical. A customer communications management (CCM) platform that enables efficient communication can be the most valuable tool.

Even better, CCM providers like Doxim can be leveraged to ensure best practices in data collection, storage, and application, which effectively enables the future utility.