See How Credit Unions Are Finding Success with Enterprise-Wide CRM

For credit union leaders today, digital transformation is a key strategic initiative across the board. Increased competition, changing member preferences, and a plethora of new communication channels all complicate this initiative, however, as change leaders find themselves asking which transformation project to tackle first.

After all, digital transformation is a profound shift in a credit union’s way of doing business, and incorporates technological changes, alterations to business processes, and cultural changes as well. This often makes prioritization a challenge.

One useful way to break down this enormous task and to prioritize the right projects is to look at transformation through a “members-first”, or CX-driven, lens. And indeed, when banks were asked last year about the biggest opportunities in banking for 2019, optimizing the customer experience emerged as a major priority, according to the 2018 Digital Banking Report.

When viewed through this member-driven lens, certain digital transformation projects immediately become top priorities (these could include projects like enhancements to channels, or improvements to customer service), while others take a back seat.

During a recent webinar, two Doxim clients, Westminster Savings Credit Union and Copperfin Credit Union, explained how their credit unions are managing successful digital transformations by keeping the focus on their members. One commonality the two organizations share is the selection of enterprise-wide CRM for credit unions as enabling technology for a better member experience. Here’s how the two credit unions arrived at that decision, and what resulted from that choice:

What motivated these credit unions to focus on CRM?

During digital transformation, credit unions have to choose between many projects, all seemingly essential, all promising improvements in member experience. So, why prioritize CRM?

For both Copperfin Credit Union and Westminster Savings Credit Union, digital transformation strategies centered on both broad, transformative goals, and a shorter list of top-priority pain points, many of which related to data access and effective CU-wide communication and collaboration.

“Our whole business is built around our relationship with our members, and their experience, so improving that was number one,” says Steve Marquis, VP of Sales & Member Experience at Copperfin Credit Union. “And number two was our team member experience, because nothing comes to life for your members if it is difficult for team members to support them and do their job”.

Copperfin leaders concluded that capturing data from members and communicating it freely between team members would streamline member-facing processes, and prevent members from having to repeat their requests to multiple employees. CRM was the right technology to make this data capture and reporting possible. Plus, a modern CRM system would allow Copperfin to connect multiple sources of member information, and provide a complete, actionable understanding of members and their financial ecosystems.

For Westminster Savings Credit Union, data access was also a priority. “We didn’t have a system that housed everything and gave that nice holistic view of the member,” says Niki Jelstad, Manager of Customer Experience at Westminster Savings Credit Union. “And not only [a view of] the member, but the household, and the other individuals in the household.” Getting a holistic member view would help uncover valuable opportunities for Westminster staff members to serve and advise their customers better.

The Westminster Savings Credit Union team also wanted to be able to track metrics like the effectiveness of marketing campaigns, and sending and tracking referrals across four lines of business was also a top priority. Recognizing that a CRM solution would not only optimize the member experience, but also help employees understand how the credit union was functioning, they moved ahead with their CRM project.

What benefits has CRM offered?

For both Westminster Savings and Copperfin credit unions, rolling out CRM has offered ROI in terms of both operational efficiencies and member experience enhancement. Both organizations recognize how CRM has helped staff members make informed recommendations, improving the overall member experience, building trust, increasing retention, and driving sales.

Westminster’s Niki Jelstad also lists other benefits her credit union has realized from CRM, including:

- Streamlined, consistent customer service

- More valuable interactions with customers

- More employee engagement

- Better handoff and communication between departments

- Better service through improved efficiency

Meanwhile, at Copperfin Credit Union, data access is radically improved by the implementation of CRM, and this has lead to many positive changes. Today, an advisor serving members can prepare for their conversation easily through a “one stop shop” for member information.

Copperfin leaders also see their CRM, and the broader Doxim Customer Engagement Platform, as key pieces of a broader strategy to provide incremental value to members. This strategy also includes a heavy focus on member journey mapping and applying Lean methodology (a systematic method originating in Japan, centered on continuous improvement and waste reduction) to optimize the nuts and bolts of the credit union’s operations.

The Time is Right to Consider CRM

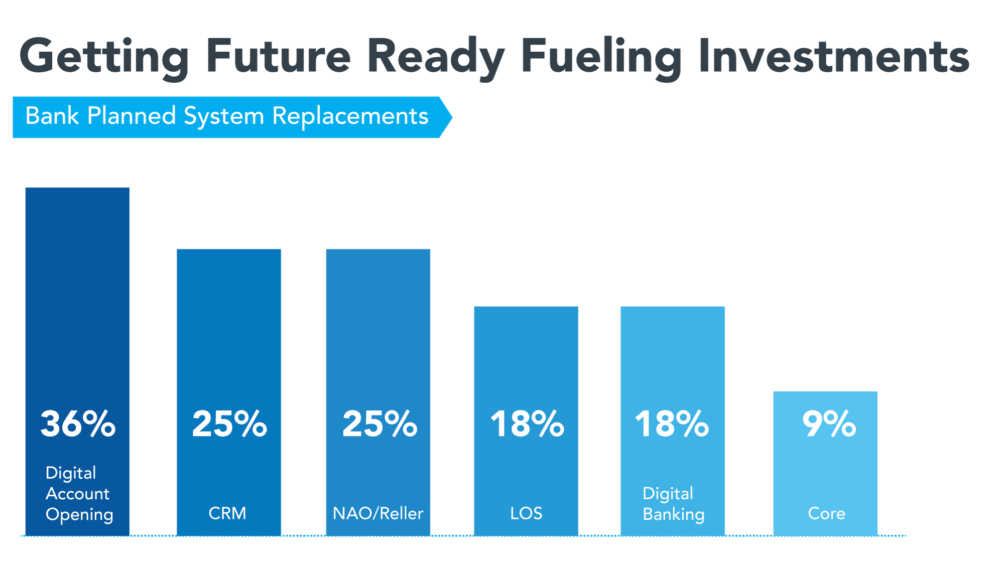

If your organization is considering implementing a new CRM, or replacing a dated one, you are not alone. Recent research from Cornerstone Advisors indicates that 25% of banks are planning to do the same.

Why the focus on CRM? Because, at the end of the day, CRM brings benefits to every department by helping teams from sales, marketing, member support, and other groups share and analyze member data. It acts as a central access point for member information from various channels and sources, and gives your credit union valuable insight into everything from member needs to the sales cycle. It allows your team to track metrics, from how your marketing campaigns and member acquisition and retention strategies are performing, to how long it takes to serve a member in branch.

The sheer breadth of improvements made possible by enterprise-wide CRM makes it a natural choice for organizations, like Westminster Savings and Copperfin credit unions, that are seeking ways to provide more value to members through digital transformation. Just think of the value it could offer your financial institution!

Hear more from Copperfin and Westminster Savings Credit Unions

To learn more about the CRM journeys of Copperfin Credit Union and Westminster Savings Union, simply click below to watch this recent American Banker panel discussion, sponsored by Doxim, on “The Strategic Importance of CRM for Modern Customer Engagement“, featuring change leaders from both organizations.

[wm_call_to_action caption=”Subscribe to get updates” button_text=”SUBSCRIBE” target=”_blank” button_size=”l”][/wm_call_to_action]