Expert Perspective: Balancing Security, Compliance, And Customer Experience During Customer Onboarding

Obtaining maximum security compliance during account opening and loan origination is always a balancing act.

Financial institutions must adhere to stringent risk mitigation rules, industry regulations and compliance requirements. But they must also create a frictionless customer experience for an ever-increasingly impatient and busy customer base.

These two imperatives can seem like a tug-of-war, with your risk mitigation and compliance teams on one side, and marketing, sales, and customer experience on the other. But a balance can be reached, with the right strategies and tools, so the customer’s ID can be thoroughly verified, and security checks run, without making the application process any longer or more onerous than it needs to be.

At a recent Doxim online seminar, security and compliance experts from Doxim, Mobetize, and Instnt shared tips and best practices on avoiding digital fraud while providing an exceptional customer experience (CX) during origination. Below, you will find some of the insights they shared about managing identity verification during customer onboarding, without eroding CX.

If you were unable to attend the live broadcast, you can watch the webinar on-demand, or read on for an overview of the insights from these business leaders.

Building trust in onboarding, without adding friction

During the account opening or loan origination process, your customers are trusting you with their sensitive financial information. But, to do so comfortably, they need to understand how this data will be used, and how it will be protected. At the same time, your goal is to protect your financial institution from bad actors and fraudulent applications, without making life difficult for actual customers and prospects.

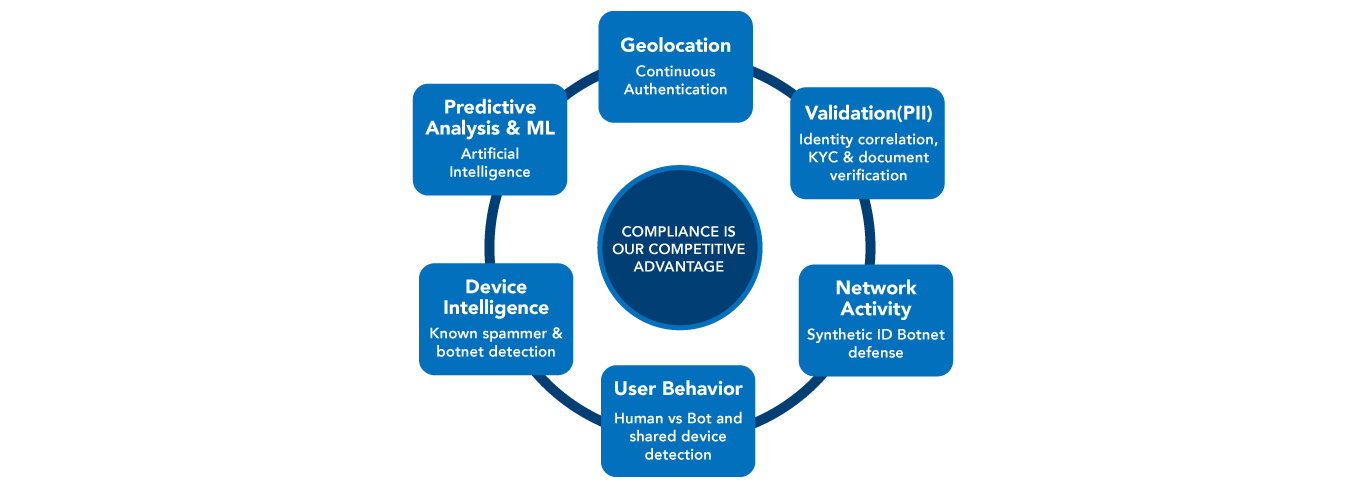

To build trust for both parties during onboarding, you need identity verification processes built right into the origination process. This layer of verification takes place during the application process, with minimal impact on the customer, and should include a sophisticated combination of the following:

- Device intelligence

- User behavior analysis

- Network activity review

- Validation (including identity correlation and document verification)

- Geolocation

- Predictive Analysis and Machine Learning (AI)

By orchestrating identify verification through a single, unified model, which is largely invisible to the customer, you can sort customers into three groups – good customers, bad actors, and questionable applications which require a manual review process.

This allows good, verified customers to proceed through the application effortlessly. Synthetic ID fraudsters, botnets and spammers are stopped at the gates. And those few customers whose applications show red flags, but may still be valid, are handled in a timely manner, because behind-the-scenes identify verification reduces the operational load on your verification staff.

The benefits of integrated and automated identity verification during onboarding

Your customers are accustomed to the convenience of targeted recommendations, one-button ordering, and same day delivery. To keep pace, your financial institution needs to supply a similarly appealing and convenient account and loan origination process. Doing so, while not compromising security and compliance, can offer a host of benefits for both your customers and your bottom line. These benefits include:

- Improved customer journey and onboarding success – As research from Forrester indicates, “Overly complex processes lower adoption significantly.” With a user-friendly digital origination process that integrates next-generation identity verification, you can ensure that customers complete their applications in an accurate, timely manner, and do not abandon the application due to complexity.

- Enhanced revenue and a process that attracts targeted demographics – Today’s up and coming generations live their lives online. By implementing a digital origination process, you make it appealing for them to do more business with you.

- Increased operational efficiency and reduced costs – manual identity verification and KYC processes are costly and time-consuming. By implementing automated identity verification that draws data from multiple sources, you reduce operational load and speed the application and approval process. Instead of manually intervening in many applications, your staff members can review a much smaller group of applications that have not automatically passed identity checks but may still be valid.

- Increased cross-selling opportunities for financial products – If you select a secure digital origination platform which allows customers to open multiple accounts and loans at the same time, you can answer more of their financial needs at once, building both revenue and loyalty. For example, a customer might choose to apply for a mortgage and a HELOC at once, and also open a savings account at the same time. This approach works best if data is shared across applications automatically, so customers do not have to enter the same data (e.g. address, employment information, etc.) more than once.

- Reduced fraud and enhanced compliance – By using an orchestrated identity verification system, you can meet all your CIP/KYC/AML requirements, and maintain full compliance with FINTRAC, while also reducing your annual fraud losses significantly. This results in an appealing ROI for the solution and offers the added benefit of fully auditable compliance and KYC records.

- Customer retention – Onerous processes, high false rejection rates, and a lack of available digital services can all lead to customer churn. Today’s financial customers are more likely to have accounts across several institutions, so they have less brand loyalty, and the barriers to switching providers are lower than ever. These realities mean that you have one chance to get the origination process right and retain your customer. Erroneously rejecting an application or taking too long to approve can cost you not only the profits associated with that account, but also the other revenue that makes up the customer’s lifetime value.

When onboarding new customers, building bilateral trust is the name of the game. Our experts concur that while customers want the speed and convenience of digital financial services, they also expect their FI (financial institution) to provide the highest standards of security, encryption, and fraud prevention during the onboarding process. Equally importantly, FIs must be able to trust the customer who is trying to access their services, and this trust is even more critical as the industry moves from the physical world of branches into the digital world of financial solutions delivery.

Are you ready to explore how a unified system for fraud prevention and compliance, built right into a digital loan origination and account opening process, can reduce fraud losses and increase revenue for your FI? Book a conversation with a security expert now, and we can explore your needs together.

To learn more about cutting-edge compliance and fraud prevention solutions, and how they work, watch our on-demand webinar “How to Achieve Maximum Security & Compliance During Digital Onboarding.“