Pandemic Propels Financial Institutions Towards Digital Maturity

The financial services industry has long been ripe for digital disruption with many organizations already fast-tracking their digital transformation efforts – driven by consumer expectations, an evolving competitive landscape, regulations and technological advancements.

However, according to a recent report by Deloitte, despite consumer willingness to adopt and many financial institutions’ willingness to invest, “digital has remained inconsistent across players, markets and continents.”

But, COVID-19 has been a catalyst for unprecedented, digital change. It has forced people out of their comfort zones where physical interactions were the norm, into a contactless world, where digital interactions are the new normal.

It is no surprise that bank branch visits reduced drastically in 2020, as customers opted for digital banking as a safer, more efficient option.

The pandemic also accelerated the rate of digital transformation in banking.

The bank’s sales jumped from 25% digital to nearly 75% digital during COVID-19, condensing 10 year’s worth of changes into two months”

It’s evident that financial institutions need to mature digitally to ensure agility and resiliency in the new normal and to ensure survival in the highly unpredictable path ahead.

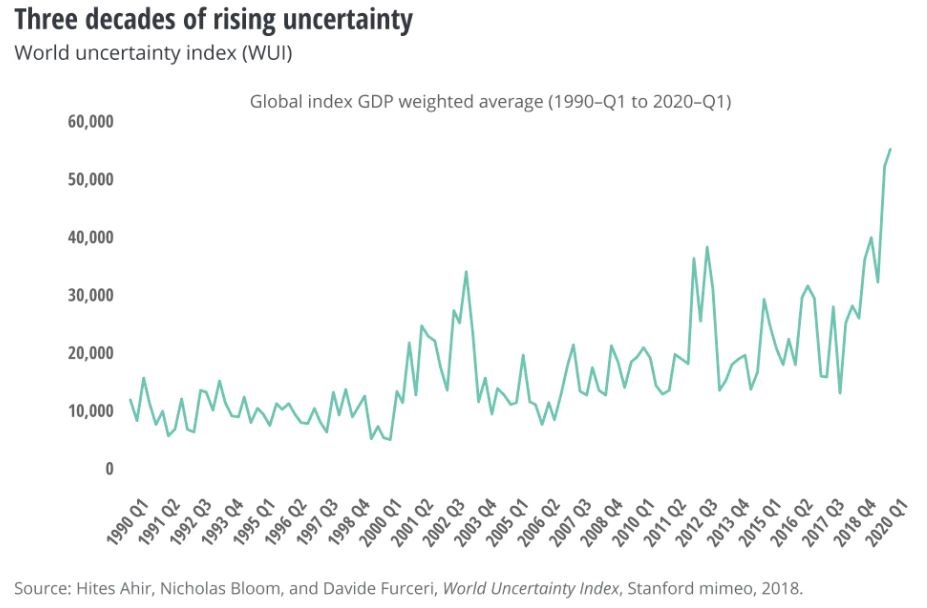

Below is an uncertainty index, provided by the International Monetary Fund and Stanford University. While it is clear that the pandemic caused a spike, it shows that overall uncertainty has been increasing steadily over time:

Digital maturity is key to ensuring the future success of financial institutions

Now that the dust from the COVID-19 storm has started to settle, getting a measure of the company’s current digital maturity is key to defining a digital transformation strategy for 2021.

How financial institutions can achieve digital maturity:

- Use a METHOD to benchmark digital maturity

- Select the right TECHNOLOGY

- Hire and nurture the right PEOPLE

METHOD: Digital Maturity Framework

A digital maturity framework provides a picture of how your organization compares in an increasingly competitive, digitally savvy industry. Using a framework like the one below (which has customized elements that fit your sector) helps to pinpoint where your organization sits and where it aspires to be.

The outcome of working with this framework is a digital transformation strategy, a plan for execution, and a map of the technologies required to support the strategic goals. GET IN TOUCH

TECHNOLOGY: agile strategy with agile execution

To compete, banks and credit unions need a foundation in systems and processes that enable agile responses to the changing needs of customers and members.

What are the building blocks of an agile organization?

- A best of breed tech stack that can fill major gaps and support each of the key components of ‘great customer experience’

- A modern architecture that is secure, compliant and scalable

- A focus on gathering, analyzing, and applying data to personalize experiences

- A smart way to approach agility is to outsource as much complexity as possible so that the bank can focus on customers instead of technology issues.

PEOPLE: align the entire organization with your CX goals

One of the most important goals for 2021 must be to change the mindset of the entire organization – right from the CEO and senior leadership down. Inspire employees by demonstrating their impact on CX and communities overall.

Remember to focus your full-time employees on their core competencies while reskilling them. Unfortunately, hiring and training the right people takes time and investment that you may not have in the current environment. This is another reason to leverage outsourcing – both for your CX technology implementation and for executive functions.