How Financial Institutions Can Stay Connected With Customers In An Evolving Omnichannel World

The channels financial services providers use to communicate with their customers continue to evolve in response to consumers’ ever-changing preferences. A number of forces are driving the shift in communication channel preferences, including the disruptions caused by COVID-19, as well as concerns about security and data privacy. These forces are expected to have a significant effect on how financial institutions interact and communicate with their customers.

As we continue to navigate into the future, it will be more important than ever for banks, credit unions and wealth management institutions to maintain a meaningful connection with their customers, members and clients.

A lapse in communication could erode the trust relationship, and in some cases, a breach of trust can be enough to make a customer switch to a competitor.

Omnichannel Customer Communications Are Becoming More Complex

Today’s consumers want the freedom to select their preferred communication channels. The number of available communication channels has greatly expanded in recent years and now covers everything from traditional print correspondence and email notifications to the more recent, such as digital voice assistants.

When it comes to establishing a connection with a financial services provider, however, consumers don’t distinguish between old or new channels – but instead, expect to have access to and communicate via all channels. In addition, they want to seamlessly access their preferred channels anywhere and at any time.

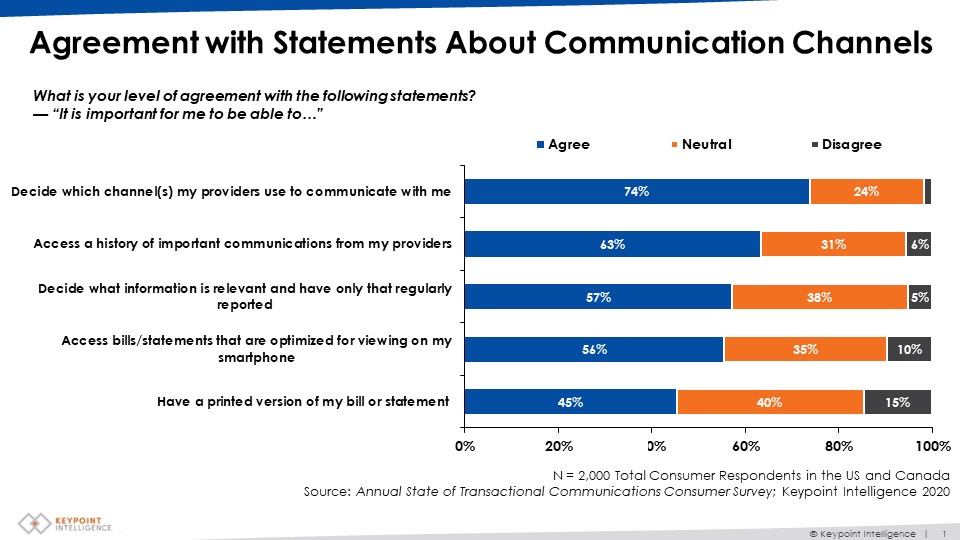

As shown in Figure 1 below, nearly three-quarters of respondents to Keypoint Intelligence’s transactional communications research wanted to decide which channels their providers should use to communicate with them.

In addition, well over half wanted the freedom to select the information that was most relevant to them and have only that information represented regularly.

Figure 1: Agreement with Statements about Communication Channels

While omnichannel addresses the need for unified communication that spans numerous channels, the messaging and content development have become increasingly complex.

The COVID-19 pandemic has served to increase the complexity associated with providing a seamless and personalized customer experience across all channels. Although the transition to digital is clear, well-publicized security breaches and public awareness regarding personal data remain front and center in the minds of consumers, emphasizing the need for a unified and secure experience across channels. As a result, consumer preferences have become increasingly difficult to model on a total, generational, or even economic scale.

To this point, the family makeup of US households has shifted in recent years. We are seeing a substantial rise in single-parent households, whose preferences and demographic makeup can be quite varied.

Keypoint Intelligence’s most recent transactional communications research suggests that roughly 40% of single-parent households prefer to access transactional communications primarily through mobile apps, whereas non-single parents prefer using a provider’s website/portal.

As this shift in communication preferences evolves, financial services providers will be challenged with implementing a customer communication approach that enables a full omnichannel customer experience in real time.

The lessons learned from the pandemic suggest that financial institutions need to take pause and reassess how they connect with their customers, while also taking strategic steps to continually monitor their channels, ensuring their ability to enhance the customer experience with personalized and relevant communications.

The Importance of Channels to Delivery Strategy

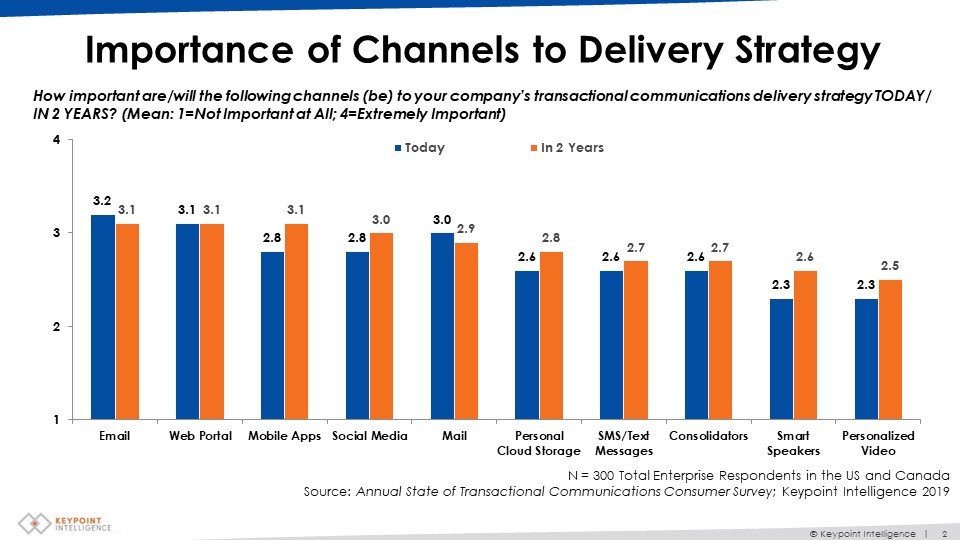

In Keypoint Intelligence’s most recent research, organizations were asked to specify the importance of various channels to their transactional communications delivery strategy, now and in the future

Responses were rated on a scale of 1 to 4, where 1 meant “not important at all” and 4 meant “extremely important.” Figure 2 above provides the average overall score for each channel, and higher values indicate greater importance. Figure 2: Importance of Channels to Delivery Strategy

Based on these findings, it is evident that channels like mobile apps, smart speakers, social media, personal cloud storage, and personalized video are expected to become increasingly important to transactional communications strategies over the next two years.

Strategies for Success

Regardless of which channel-or better yet, channels – you choose to establish and maintain a connection with your customers, it’s important to keep a few things in mind:

- No channel is an island! No matter how effective a certain communication channel might be in a certain situation, there is no single “magic bullet” channel that can always be relied on for ultimate efficacy.In most cases, the best communication strategy will include a combination of channels that all work together seamlessly to drive the same message home. For example, printed communications can be quite effective at directing financial services customers to digital channels to improve the customer experience.}

According to Keypoint Intelligence’s 2020 study entitled Vertical Industry Views from a Socially Distanced Perch, over 90% of financial/banking respondents were sometimes or frequently coordinating their direct mail campaigns with email or other digital media.

- Demographics matter. Although a Gen-Z consumer might welcome regular text messages from their bank, credit union, or wealth management company, these same texts might be off-putting to a Boomer.Demographic differences do exist but are not always sufficient to address the complexity of today’s omnichannel communication preferences. It’s important to learn about your customers’ preferences while resisting the urge to make assumptions based on demographics.

- Put the customer first! The best way to bridge the gap between yourself and your consumers is to give them what they want – choice! Enable your customers to select the channels that you use to communicate with them, and then honor their communication channel preferences.Personalization of content is also required to make communications especially relevant to the individual recipient. According to Keypoint Intelligence’s Vertical Industry research, nearly 95% of banking/financial respondents achieved higher response rates on direct mail campaigns that incorporated customization/personalization.

- Innovations in communication are a constant! Don’t be misguided into believing that innovation is only for new communication channels. As a matter of fact, all communication methods are in a constant competitive state of flux, with new innovations bringing strength and renewed relevance all the time. For example, innovations in print-based augmented reality can bring new life to marketing inserts and direct mail for the banking, credit union and wealth management segments.Communication channels and their technological stakeholders will continue to evolve their positioning and value.

The Bottom Line

As we continue with this series of blogs, my colleague Eve Padula and I will share some of the key trends uncovered by Keypoint Intelligence’s recent research.

As previously stated, no single trend stands alone – customer communication channels are all interdependent on each other to drive loyalty and satisfaction. In future installments, we will explore how hyper-personalization can help drive a better customer experience in the financial services industry.

Financial services providers need to continually evaluate and adjust their outbound and inbound communication strategies to ensure that they are capturing the consumer sentiment toward channel selection.

At the end of the day, consumers will remain the most loyal to businesses that enable them to communicate on their own terms in a simple, seamless way. No customer wants to be put on hold for an extended period or led to a dead end because they can’t find their account number – the customer experience matters!

It is up to businesses to determine their customers’ communication channel preferences, while also realizing that what works for one customer may be completely off-putting for another.

Customer satisfaction hinges on having foresight into what your customers want and then delivering communications from a platform or provider that can reflect that level of knowledge.