How To Achieve Quick Wins Using A Digital Maturity Framework

Despite the acceleration of digitalization and channel adoption, most organizations still have a long-term outlook for their digital transformation strategy. This is especially true when the organization has to replace or integrate core systems.

While transformation takes time, it’s important to keep internal teams motivated with quick wins, as well as find opportunities for small improvements that result in noticeable changes for the customer.

It helps to map your digital transformation plan onto a digital communication maturity framework that identifies both the big picture goals and the smaller, incremental changes that are vital to a sense of progress.

Customer communication within a digital maturity framework

For today’s connected consumers, digital communication plays a vital role in building relationships and is a great way to kickstart enhancements to the customer experience.

Plotting the maturity of your organization’s digital communication onto a fit-for-purpose framework provides a basis from which to plan an improvement strategy. This helps you to understand the incremental gains that will immediately improve CX.

At Doxim, we’ve spent time developing and refining our Digital Communication Maturity Framework, to help our clients build a communication transformation plan on both a short-term and long-term basis.

The framework helps to identify and implement quick, short-term wins to improve communication, while also framing the requirements to achieve the company’s long-term strategy for digital communication.

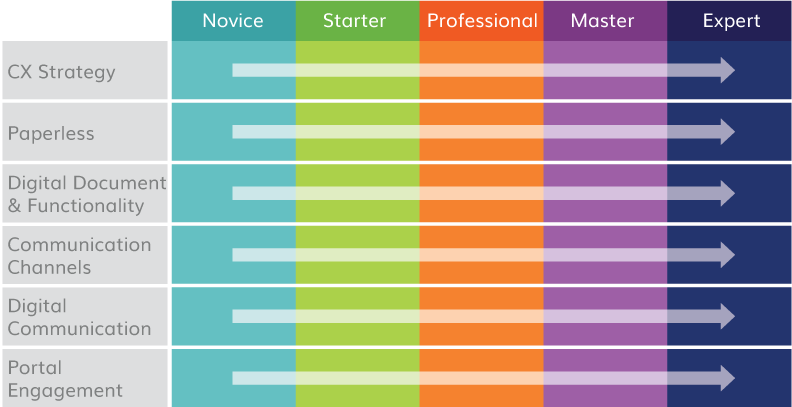

Doxim’s Digital Communication Maturity Framework

Our framework benchmarks an organization’s capability across six key competencies and measures progress from Novice as the starting point to Expert as the ultimate goal. This model is built to focus on digital communication capabilities and place the organization into a particular level for each competency.

An important part of the process is to document the ‘as is’ situation to understand where each capability is positioned at the start. This forms the basis on which to plot actions that will move the business towards the next status level within the framework.

Another vital part of the framework process is to agree on business drivers. Most clients say they want to enhance their digital communication to improve customer experience. However, when prompted on specifics, it becomes evident that cost efficiency is the goal and customer experience the nirvana.

Unfortunately, starting with cost efficiency as the main business driver is not conducive to creating a great customer experience.

Transformation drivers an indicator of digital maturity

Over the years, we’ve noticed a correlation between digital communication maturity and business drivers. Digital novices and starters are likely to be driven by cost awareness and efficiency, but as a company moves along the maturity line, the business drivers become more strategic.

The maturity framework cannot exist in isolation, however, and neither is it a once-off exercise. The process only adds value if applied in conjunction with customer journey mapping, and measuring progress along the way to keep moving towards Expert level.

Doxim’s Digital Communication Maturity Framework Workshops

Doxim brings years of experience and capability in digital communication that will help you transform your customer communication experience.

Our strategic consulting and advisory team has developed tiered workshops, catering to small, medium and large companies and addressing different requirements.