A big challenge associated with healthcare communications is complexity – trying to figure out the benefits of your health plan, what’s covered, what’s owing, what the extra costs are, etc. Paper also continues to be the only option available from healthcare providers, which is not ideal, considering patients have the choice to interact with other service providers on many different channels. This causes a fragmented patient experience overall, a lag in meeting patient expectations and a poor patient experience.

Cut down on operating costs by shifting customers to digital channels and at the same time, delight them by providing the channels they want and interacting with them in a more engaging environment.

Learn how Doxim can help your healthcare organization achieve its digital patient communication goals Book a Demo

Why was healthcare lagging in terms of digital adoption pre-pandemic?

Part of the challenge in the healthcare industry has been due to concerns around regulations like HIPAA as well as the security of digital channels. This contributed to the lag in digital adoption before the pandemic.

The rise in the necessity of digital channels during the pandemic resulted in sharp increases in the number of first-time users. McKinsey says that consumer adoption of digital channels vaulted 5 years ahead within 8 weeks – healthcare providers went from zero to 100% telehealth within a matter of weeks. COVID-19 really boosted the healthcare industry in terms of digital transformation.

The pandemic also propelled the ‘silver tsunami,’ namely the older generations, who had to learn how to use digital channels to communicate with their families and to get critical services such as healthcare.

Because the healthcare industry was forced to leapfrog into digital services, healthcare providers need to get their patient communications up to speed as well. There is an opportunity now to revise and revamp patient communication to meet the digital expectations of customers.

Security of digital communication vs traditional paper methods

People are so accustomed to physical mail delivery, but is it really secure? There are many privacy concerns relating to physical mail – theft, incorrect delivery due to human error and mail that is simply undeliverable.

We need to debunk the myth that physical mail is safe and secure, because stories about theft and loss are not uncommon.

According to The New York Times, the rate of package theft in the United States has been steadily increasing, with 90,000 packages disappearing daily in 2019 in New York City alone, up 20 percent from four years prior.

Across the country, more than 1.7 million packages are stolen or go missing daily, adding up to US$25 million in lost goods and services.

Digital delivery is far more secure than paper because it takes human intervention out of the equation, thus eliminating error and potential opportunity for theft. Digital delivery requires security all the way through the process – on the portal, as well as on the source systems – there are many layers of security and authentication.

Customers want digital. Don’t shy away from providing what patients want because of security concerns, rather balance customer experience with security and find the right solutions to deliver communications in a secure format.

How can digital healthcare communications improve patient experience?

Providing the information as and when the patient needs it and, in the manner, they prefer, is the key. Few people would want to get a benefits statement or test result in the mail when they can get it immediately in a digital format.

More than 70% of patients today prefer digital communications; more than half expect digital capabilities. So, providing digital options cannot be a conversation of the future.

Creating a happier patient means providing a platform that makes it faster and easier to consume important information.

A happy patient is a more engaged and receptive one. A happy patient is more likely to call their doctor (telehealth), get their documents self-serve from the safety of their home, put their credit card details into that payment portal – and drive down the revenue cycle time / time-to-pay.

When patients are considering whether to move providers, digital capabilities will be one of the criteria they use to assess their options. Meeting digital expectations becomes a retention imperative.

Best practices for moving patients and organizations toward digital maturity

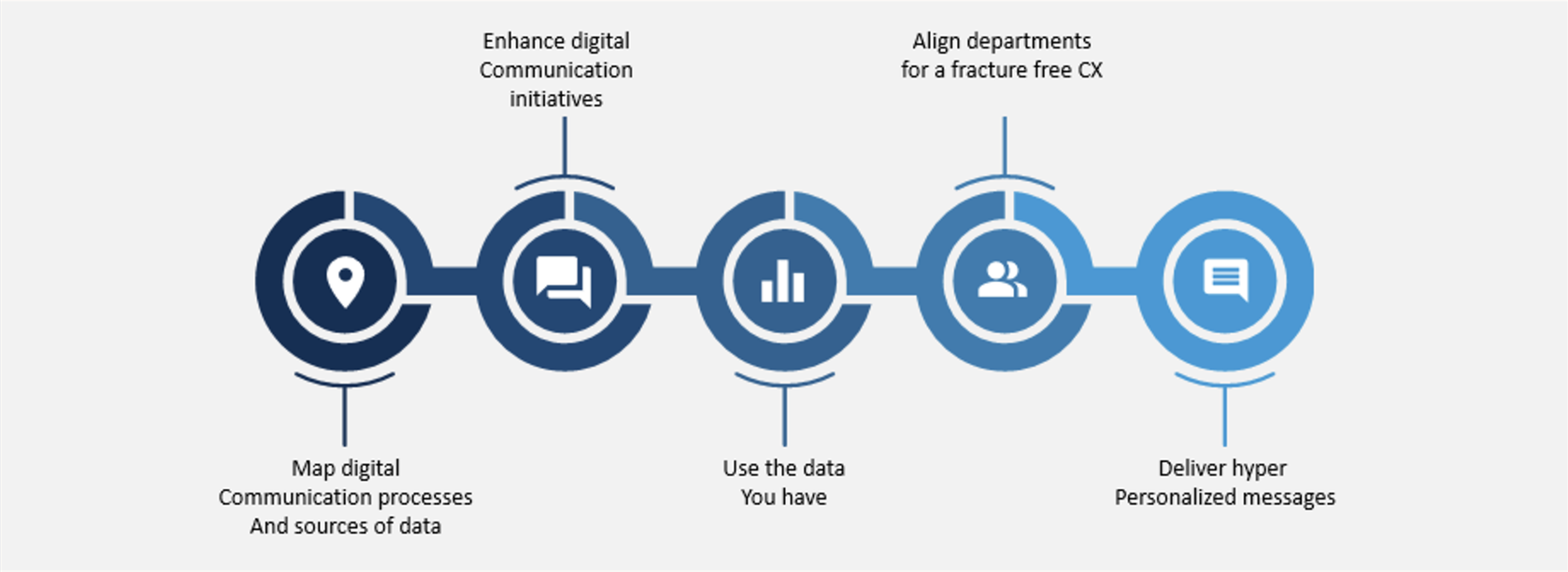

There are several ways to approach digital maturity. It is not an end goal; it must be seen as a journey. We use a digital maturity framework to plot the starting point for healthcare providers and identify what needs to happen to move them along the framework.

It’s about starting TODAY. Make micro-changes that make a difference to patients today, tomorrow and next week.

It’s not about a 5-year plan. Rather break up the projects into bite-sized chunks that will make a real difference to the patient. This is far easier in a digital environment.

Start with what communications you are currently sending and what channels you offer. What can you change to improve adoption and reduce friction in the process? There are many little enhancements you can make using the data already on hand.

Getting started and committing to the path is the way to make forward progress.

Customer communication management (CCM) technology is designed to solve many challenges associated with paper-based customer communications.

Here are five key ways in which a customer communication management solution can benefit your healthcare organization:

1) Integrated omnichannel communications – across all industries, customers expect to receive their communications through their channel of choice. They expect healthcare organizations to respect these preferences as well. Given the sheer number of communications you must provide to patients, and the recent and ongoing proliferation of communication channels, a communication management system quickly becomes essential to keep customer communications synchronized.

2) Accessibility compliance – Persons with disabilities expect their critical healthcare communications to be available in a format they can access. But meeting accessibility requirements can be overwhelming, as your organization is already stretched to meet day-to-day business requirements. Working with an experienced partner can help you meet the needs of the large and growing population of patients with disabilities.

3) Enhanced patient experience – the healthcare industry is seeking innovative ways to enhance the patient experience and build stronger patient relationships. As the world moves online, providing patients with digital options to review their communications and pay their bills is a simple way to build engagement and trust. The post-pandemic digital shift also means that when patients are considering whether to move providers, digital capabilities will be one of the criteria that they use to assess their options. By adopting a customer communication management platform, your healthcare organization can stay ahead of the curve and retain patients.

4) Improved security and regulatory compliance – healthcare data is, by its very nature, ultra-sensitive. Customer Communication Management solutions built for this industry are created with privacy and confidentiality in mind, and communication-related data is housed in data centers with comprehensive security protocols in place. Home-grown communication solutions may not offer this level of safeguard.

5) Simplified payments – with the industry shift towards patient responsibility for payments comes a new challenge. Your patients need to clearly understand their financial obligations, and they require access to easy ways to pay their bills. A customer communication management solution with integrated, multi-channel communication and payment options can help reduce your revenue cycle time, while increasing patient convenience. That’s a win-win for your organization and your patients!

CCM technology allows you to stay ahead of the curve when it comes to patient communications and digital adoption.