What To Do When Your Paperless Adoption Rates Stagnate

Paperless Adoption

Improving paperless adoption is key to any digital transformation strategy. But too often, organizations assume that customers want to communicate digitally because that’s the general trend. But, unless you have asked each customer directly, you can’t really speak for them.

One thing is certain, customers will only let go of what’s familiar if something equivalent or better is offered.

This is evident when companies attempt to reach their paperless adoption targets by repeatedly offering customers the same digital channel as the paperless option. For example, the utility company that asked customers to switch paper off and tracked responses from the email request to successful portal registration saw an 85% drop off rate from the initial email click to registration. Why were the paperless adoption results so poor?

The answer is pretty simple: you cannot give customers the same option over and over again and expect to receive a different result. That is the definition of insanity.

This particular utility was promoting paperless adoption, but only provided customers with the option to fetch their documents from a web portal each month. While many of these customers had already registered for the portal, some didn’t select it as their paperless channel. Why?

The recommended channel did not satisfy enough of their customers’ needs, which meant they weren’t motivated to move off physical channels completely. They still preferred to receive communications such as bills, statements, and the like, in the traditional way.

If the recommended digital channel fails to meet the customer’s needs, there is no point in continuously asking them to use that channel to go paperless.

The multichannel gap is an opportunity

Something to consider: the leap between receiving a paper bill or statement in the mail, and logging in to self-serve on a portal, might just be too wide for some digital novices.

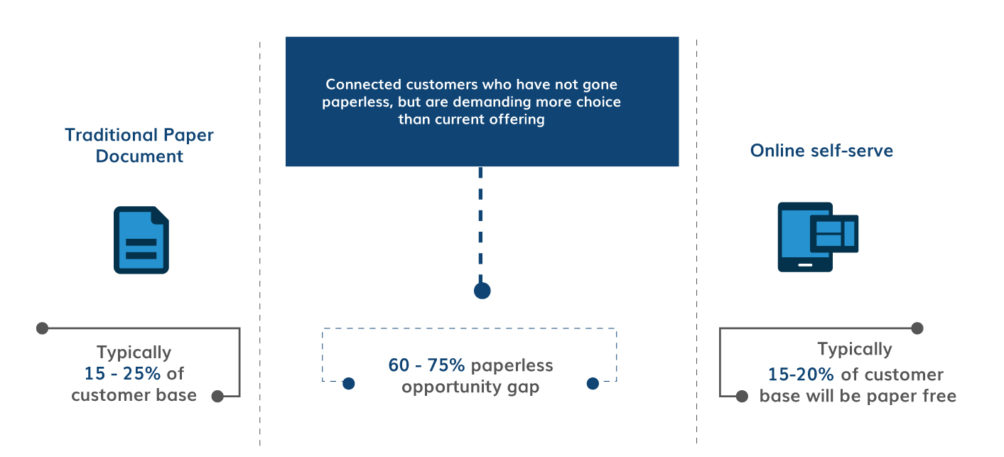

We call this the multichannel gap. It occurs when traditional portal presentment has done its job of getting a segment of customers to go paperless. That leaves a percentage (approx. 15-25%) still using traditional channels, such as print because that’s always going to be their choice and a percentage (approx 15-20%) that has adopted ePresentment (portal).

But, a large number of customers remain (55 – 70%) in between those two groups, who will only go paperless if offered exactly what they need.

Close the gap by offering additional paperless channels

If paperless adoption using your current digital channels has stagnated, you have the opportunity to convince a new segment of customers to go paperless by offering them additional digital channels.

Depending on the communication you are targeting, there are other channels that can provide a different customer experience. This may be the CX that the middle group is looking for, and the reason they decide to go paperless.

Alternative channels to boost digital paperless adoption

1. Send a text message with a link to the document

Perhaps it isn’t the portal that’s the problem but the fact that the customer is on the move, and views their correspondence primarily on mobile. The emails directing them to the portal get lost.

Text messaging is a good way to get customers’ attention. Include a link in the text message to the portal, but make sure that the process is simple and optimized for mobile viewing.

2. Attach the document to an email

Email is the ideal channel to send out bills, statements, and other critical documents as attachments. The document lands directly in your customer’s email inbox, which they check multiple times a day. The document is attached to the email, usually as a secure PDF, and is easily opened and accessed.

Successfully converting customers that are open to going paperless, but haven’t done so, despite being active on the portal, requires offering them a choice of alternate channels. If you want to increase your paperless adoption rate, then you need to offer these channels as part of your omnichannel strategy.