Digital transformation is essential to your credit union’s success, especially in today’s environment where organizations face increased competition, evolving member expectations, and downward pressure on budgets. To serve more members with lower operational costs, successful digital adoption is key. One of the best ways to encourage digital adoption is to enhance member communications.

But enhancing member communications often means sending more communications, and estimating the cost of this increase can be challenging. CCM vendors typically charge per communication, which means the more successful you are at communicating with members, the more you spend. This can create a situation where you become a victim of your own success, as your digital adoption initiatives deliver way above expectations, meaning your digital volumes skyrocket and your communication budget is blown.

That’s a lot of paper! And although there will always be a role for paper in healthcare communications, it does come with an increased operational cost and slower delivery timelines. That’s why it just makes sense to maximize the paperless adoption rates of healthcare communications.

Healthcare providers of all types are exploring how to increase their paperless adoption rates, as the industry continues to digitalize. Recent research by Keypoint Intelligence reveals which tactics healthcare providers feel have been most successful at promoting paperless adoption in healthcare. The results are:

- Hospital respondents (the largest group in the healthcare segment) mostly cited having an effective multichannel marketing strategy as key to successful adoption, while making it easy for patients to switch was a close second.

- For doctor’s office or outpatient clinic respondents, making it easy for patients to switch was first, while providing a better patient experience and setting realistic goals tied for second.

- All the revenue cycle management respondents said a better patient experience was a key reason for successful adoption, but also mentioned the need to focus on educating patients on the benefits of paperless adoption.

Doxim’s member communication experts can also help you encourage paperless adoption and consult on creative communication design that both promotes engagement and delivers a great user experience. BOOK A DEMO

THE DOUBLE DIPPER DILEMMA

There is another risk relating to increasing digital adoption. What if members agree to receive digital communication, but do not agree to go fully paperless? These ‘double dippers’ want the convenience of digital communication but are not yet willing to let go of the familiarity of receiving an envelope in the mail. In traditional vendor pricing, this would mean a doubling up of messaging costs. Your credit union achieves no cost saving on postage, but must add the cost of each digital communication.

Communicating with these members costs more than those that are on print only, because you are paying for both print and digital communications.

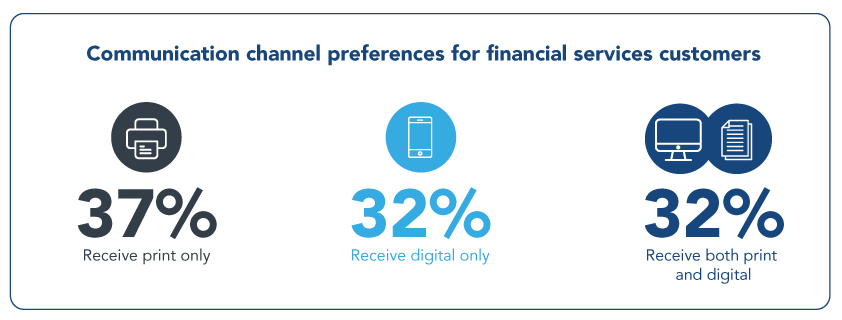

A Keypoint Intelligence report reveals that when it comes to financial services customers, over a third (37%) receive print only, a third (32%) receive digital only, and the remaining third (32%) receive both. This doubling up of costs, while positive for your omnichannel communication strategy, could be catastrophic for your budget. Based on research by KeyPoint Intelligence.

In two years, the percentage of digital only customers is expected to increase to 36%, at the expense of the print only percentage, which declines to 31%. But the number of double dippers is expected to remain the same.

This means credit unions must either adjust communication budgets to accommodate double dippers or find innovative ways to encourage them to go fully paperless.

FINDING COST CERTAINTY WHILE ENHANCING MEMBER ENGAGEMENT

Unpredictable communication costs can wreak havoc with a credit union’s annual budget. At the same time, digital communications are a critical way to increase member engagement and serve more members at a lower cost, so scaling back communication plans can cause long-term problems. By communicating less effectively or less often, you risk losing members and prospects to big banks or non-traditional options that offer more engaging customer experience strategies.

The solution to this thorny issue is to find ways to simplify your communication-related budgets, so you know what to expect on your monthly communication invoice. The truth is your digital transformation project will not be approved if the return on investment is not attractive or can’t be calculated at all. ROI calculations become far more accurate when the fee for the year (ex-postage) is fixed.

What you need is cost certainty – one predictable fee structure that covers all communications across print and digital. As you migrate members to digital, the monthly fee (excluding postage costs) remains stable. This approach simplifies budgeting and removes the need for complex invoices based on volumes that need to be audited. It also allows you the flexibility to experiment with different types of communications, like targeted offers to encourage your “double dippers” to turn off the paper.

HOW DOXIM CAN HELP REDUCE COMMUNICATION COSTS FOR CREDIT UNIONS

As a single, trusted partner offering a holistic CCM solution at one fixed cost, with predictable monthly fees, Doxim can help you take the uncertainty out of your communications budget and reduce operational costs for your member communications.

See, for example, how Doxim helped Your Credit Union reduce print costs by 70% and postage costs by 80% after implementing Doxim’s eStatement solution and by working with Doxim to educate members on the benefits of eStatements. View the case study

Take the uncertainty out of your communications budget and reduce operational costs for your member communications. CONNECT WITH ME